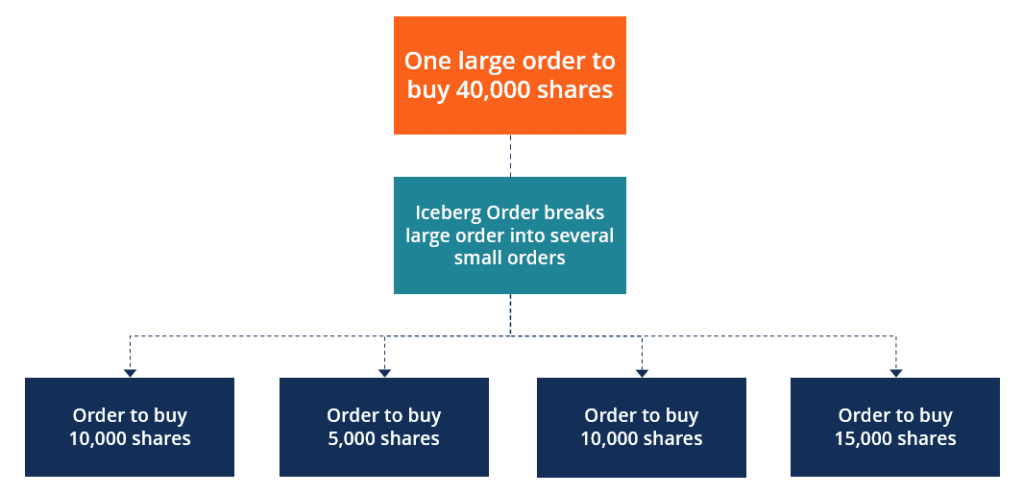

Iceberg orders occur when an individual or an entity wants to buy or sell a large quantity of financial security. They enter the market with several smaller orders instead of a single, large order.

An iceberg order is a technique that usually large institutional traders use when they want to obscure a large trade they are making. An iceberg order is a masking large order size that might significantly reduce the price movements caused by considerable changes in a stock’s or cryptocurrencies supply and demand.

Suppose someone wants to sell the equal value of USD1M in BTC. It is better to divide this big selling order into smaller parts. For example, they might order for 10 USD100K or four USD250k BTC.

Hidden Orders

A hidden order happens when an individual or an institution sends a trading order to a broker and instructs them to break up a big order into smaller portions and then are sent to exchanges separately. Hidden orders and iceberg orders are widely similar.

In both Hidden orders and iceberg orders, a big order divides into smaller orders to prevent virtual effects on the market factors such as rates, prices, and other determinative elements.

Sometimes investors interested in selling or purchasing securities, shares, or cryptocurrencies use hidden orders to keep their anonymity. The smaller size of unique transactions means that they do not usually cause investigations or don’t need declarations.

Hidden orders occur through an algorithmic trading system that randomly places orders on the order book without revealing patterns to keep the anonymity of the main trader behind hidden orders.

Difference between Hidden Orders & Iceberg Orders

“Hidden orders” and “iceberg orders” are similar, with only one difference. In hidden orders, the transaction executes after it appears in the order book, while iceberg orders get executed directly.

In hidden orders, the transaction executes after it appears in the order book, while iceberg orders get executed directly.

How to Identify Iceberg Orders?

It is hard to determine what bids or asks represent an Iceberg order, but some signs help us find suspicious orders that most likely are iceberg orders. When a symbol with the same size and offer repeatedly appears in a trading column, it is most likely an iceberg order. If a deal occurs and it replaces with another bid or asks with the same size and price, there is no doubt it is an iceberg order.

Conclusion

Sometimes, individual or institutional traders decide to sell or buy vast amounts of securities, shares, and cryptocurrencies, revealing the volume of a single transaction will affect the market trend. To prevent unwanted adverse effects on the market, they will take different strategies known as “iceberg orders” and hidden orders, which are almost the same. Simply the working mechanism is based on dividing a big trade into smaller portions. This way, retail traders’ effort to buy securities, shares, or cryptocurrencies.