After a short time after the Terra and Luna project issues and within this time, we have witnessed consequences, including the loss of users’ assets and the loss of trust in the crypto ecosystem. The users, fans, and developers of Terra Network had various suggestions for recovering this project and its cryptocurrencies. The decision was to launch a new native network and airdrop the new token to previous holders during all the contentions.

After a free fall in the Terra network and its native cryptocurrency LUNA and the stablecoin UST, the market was perplexing and dizzy. The team behind the system and many other official financial authorities worked so hard on the issue to give trust and peace back to the cryptocurrency market.

What Happened to the Terra Network and the Luna and UST?

The project was one of the top 10 cryptocurrencies “collapsed” within one week, UST lost its peg to the US dollar, and the value of the Luna token free fell to lose 99% of its market value. The Terra project is structured based on UST, the stablecoin, and Luna native token. UST is a stablecoin and should have an equal value to the US dollar fiat currency with a slight positive or negative digression from the fiat value. Several parallel failures and declines in the market caused the disastrous fall of the price for terra stablecoin. To create a UST stablecoin, it seems necessary to “burn” some Luna tokens.

To better understand when a user wants to exchange 100 USTs for a certain number of Luna tokens (depending on the current Luna price). Once the transaction accomplishes, the user will receive 100 UST, and the Luna tokens are “burned.” This approach reduces the circulating supply and positively affects the price of Luna cryptocurrency.

It took a few days, from a few hundred million tokens to 6.5 trillion, and the result was a severe failure, which caused the value to drop to zero, which conducted the largest bankruptcy in the history of crypto to loss of more than 11 billion unsupported UST tokens were left. Do Kwon, CEO of Terraform Labs, proposed to revive the Terra Network in the Terra Research and Development Forum (known as Agora). Eventually, the decision was to create a new network and launch and airdrops new tokens to previous Terra network tokens holders.

What is Tera 2.0 and the Difference Between Terra Classic?

Following the mentioned proposal, the developer team renovated the network we know as Terra and its native Luna digital currency (LUNA). The technical name of this chain is Phoenix-1, and the name of its test network is Pisco-1. The previous network will continue to operate under a new name, and we will know that with the name of the Terra Classic chain with a given new life to the ecosystem, tokens will have a classic extension.

Therefore, it will be called Luna, Luna Classic, or LUNC, and the Terra Dollar and other stablecoins of the Terra network will appear with a “letter C” extension (USTC, KRTC, EUTC, etc.) from now on.

Luna Airdrop

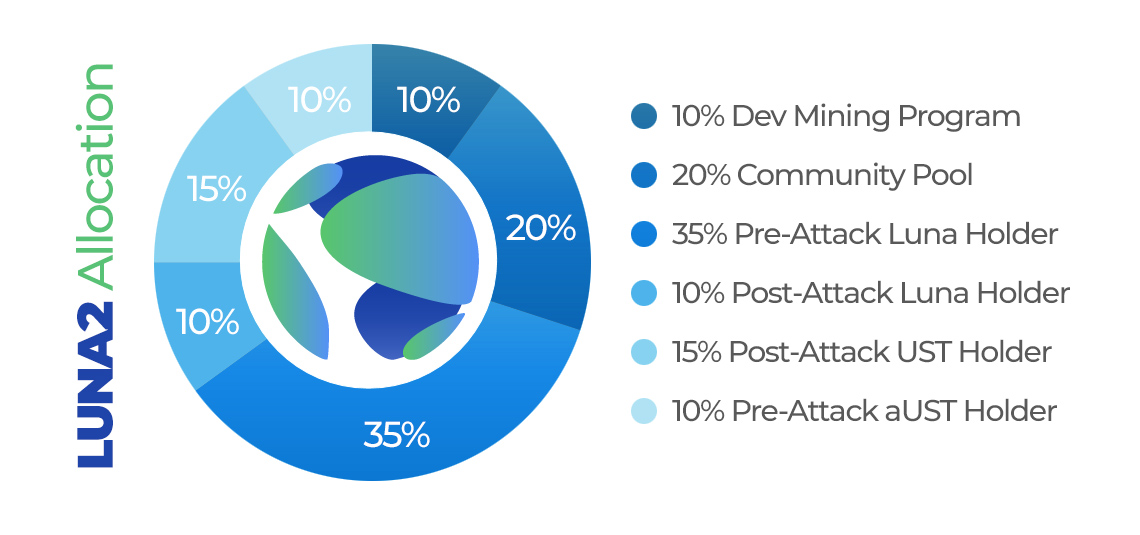

Unlike the classic Terra network, the new Terra blockchain will only include a native cryptocurrency called LUNA. The initial supply of this token is one billion. The network’s validators will stake Luna, and the current inflation (staking profit rate) of the network is about 13%. At writing, Luna’s digital currency estimated price will be $ 5.87. The market value of this coin is $ 1.23 billion, and 210 million of these tokens will be in circulation. To know more about the LUNA and cryptocurrency airdrop, please see the below chart.

Conclusion

After the bitter happenings for Terra’s ecosystem, its tokens Luna and UST, the network is looking for a revive. Most tokens belong to the community of your previous network. Will the Terra Classic network ecosystem succeed in reviving itself? Now, all we can do is observe the market behavior in the coming days and months to verify if the recent actions help the system get back the market’s verification or not.