Abstract

People in the cryptocurrency market must have thought about the question, what was the purpose of creating Bitcoin? In response to this question, Satoshi Nakamoto stated in 2008, with the publication of the Bitcoin White Paper, that the problem with all fiat currencies is that people must trust central banks to use them.

Still, the history of banks’ performance shows that relying on them has not had good results and has always caused the value of money to decrease.

The primary purpose of creating Bitcoin was to provide a way to transfer money through the Internet without the need for control by an intermediary institution and to preserve the value of money. Furthermore, this article discusses the purpose of Bitcoin and how it achieves it.

What is Bitcoin?

Before we examine the purpose of Bitcoin, we need to understand what it is and how it works. Simply put, Bitcoin is a peer-to-peer (P2P) digital currency. This blockchain network operates without central control or supervision by banks and governments, and users carry out transactions.

One of the most important features of Bitcoin is its limited supply. The total supply of bitcoins is 21 million. New coins are extracted by the mining process and rewarded to miners.

What is The Purpose of Bitcoin?

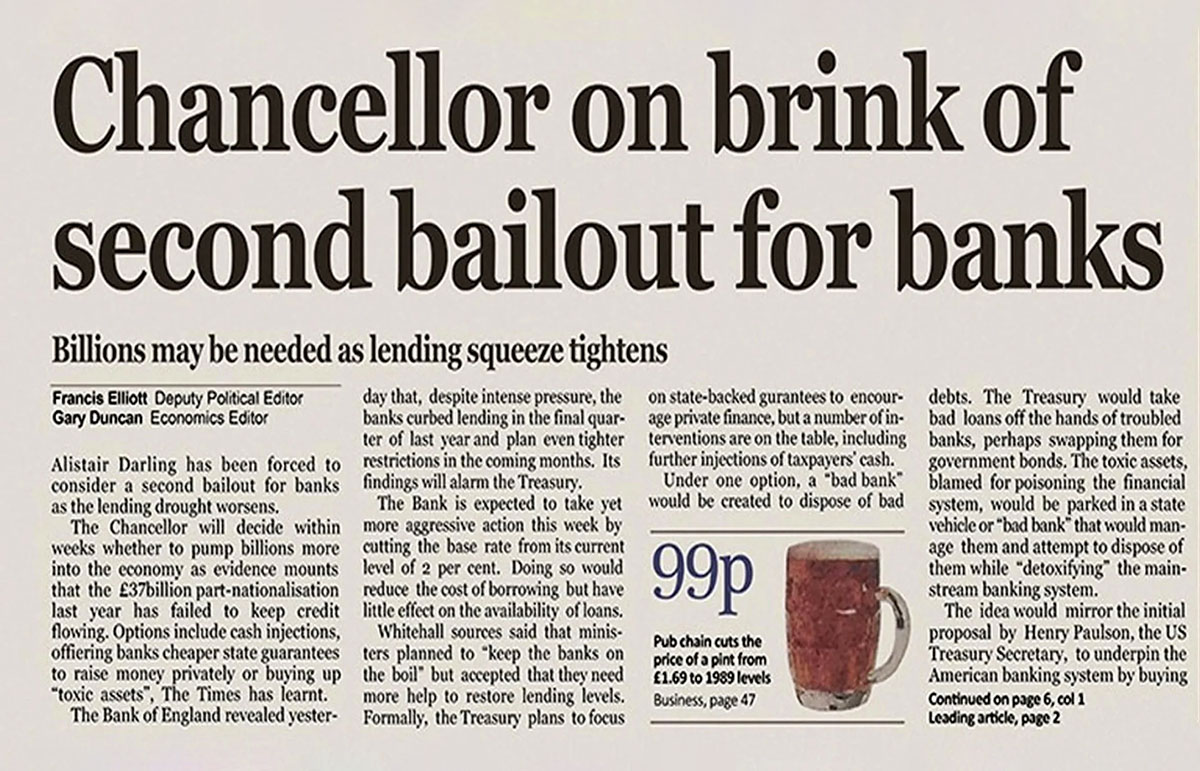

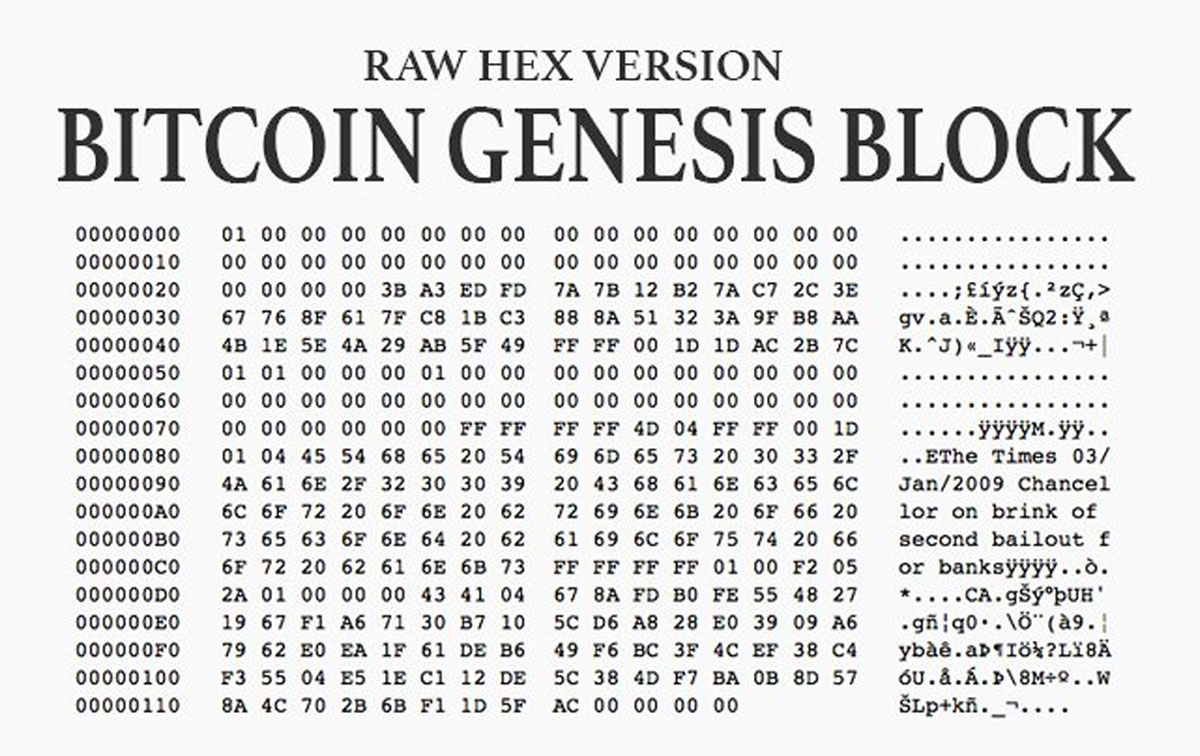

When mining the Genesis Block (the first Bitcoin block), Satoshi recorded this message: “The Times 03/Jan/2009 Chancellor on the brink of a second bailout for banks.” This message referred to the Times newspaper news published six days before the production of the first Bitcoin block.

The report published in the New York Times stated that the representative of the Crown of England in the Parliament of this country has decided to inject money for the second time to solve this country’s financial crisis. Next, we will examine the goals of Bitcoin.

1. Removal of Intermediaries

The first purpose of Bitcoin is to show the inefficiency of central banks that can easily print money and cause inflation and loss of value of people’s assets.

Also, since governments and central banks do not control Bitcoin, they cannot access Bitcoin transactions and block them. Therefore, many actions, such as sanctions, which governments use to control people, will not be possible.

2. Value Transfer

Another goal of Bitcoin is to become a peer-to-peer way to transfer money. Bitcoin was supposed to be the first electronic money and an alternative payment system that would be anonymous and eliminate the need for third-party intervention. More than a decade has passed since the creation of the Bitcoin network, and the debatable issue is whether Bitcoin has achieved its initial goal.

The Bitcoin network still suffers from scalability issues and high transaction fees, which is why many believe Bitcoin is more of a store of value than a cash alternative. The Bitcoin network currently can only process up to seven transactions per second. The Visa Card network can process more than 24,000 transactions per second. For this reason, Bitcoin can’t become a global payment method.

3. Value Retention

As mentioned earlier, there will be 21 million Bitcoin units. Since the value of an asset is directly proportional to its scarcity, however, we expect the price of Bitcoin will rise dramatically in the future. Therefore, we say that Bitcoin is a payment method that can also store value simultaneously.

Currently, gold is the most popular method of storing value. Many people consider Bitcoin to be a form of digital gold. The remarkable thing about these two assets is their price correlation. Looking at Bitcoin’s price history, one could argue that the world’s first digital currency has performed well as a store of value.

The price of Bitcoin was initially less than $1 and has slowly increased in value every year since its inception. In 2010, the cost of Bitcoin could not even reach one dollar. In 2013, the price of BTC increased to $220; by 2017, it reached $20,000; in 2021, its price reached more than $64,000. The current price of Bitcoin (February 3, 2023) is in the range of $24,000.

4. Changes in Monetary Policies

By providing a new financial payment system without the need for banking systems worldwide, Bitcoin allows all people to enjoy relative equality by playing a role in this network. In simpler terms, the Bitcoin network takes the concentration of power and wealth away from the rich and allows everyone to participate in the distribution of wealth.

Currently, the US dollar is known as the most potent exchange currency in the world. For this reason, different policies of the United States will directly impact the economy of other countries. Still, the traditional form of economy and money can shift to using Bitcoin and other digital currencies.

In simpler words, with Bitcoin replacing the dollar, the economic decisions of one country will not affect all countries.

5. Use in Global Transactions

Despite Bitcoin’s constant volatility, we can still use Bitcoin globally for transactions. Since it only takes one volt to store Bitcoin and can be transferred 24/7, using Bitcoin is one of the easiest ways to transfer money globally. Bitcoin holders do not need a bank account or a controlling third party to use it. Merchants can efficiently complete their transactions by paying minimal fees.

6. Ease of Storage

One of the essential features of Bitcoin is its ease of maintenance. All valuable goods, such as gold, jewelry, or other instruments, remain valuable.

It must be physically stored, But Bitcoin can be stored in a wallet and used without restrictions worldwide when needed just by holding the wallet’s private key.

FAQ

Q: What is the purpose of Bitcoin?

A: Bitcoin was born to eliminate intermediaries and enable peer-to-peer financial exchanges between people. Among the essential goals of Bitcoin, we can mention things like taking power from banks and governments and handing it over to people around the world, maintaining privacy in transactions, transparency in transactions, maintaining the value of money, and facilitating transactions worldwide.

Q: Is Bitcoin a form of money?

A: Bitcoin has the essential characteristics of money, but economists and lawmakers still need to accept that Bitcoin currently functions as money. Moreover, the best proof is that the number of transactions in the Bitcoin network is still low, and most exchanges worldwide exchange Bitcoin with fiat currencies. Also, due to the limited supply of BTC and its high demand, it can be said that Bitcoin is currently a commodity to hold value.

Conclusion

The primary purpose of Bitcoin is to provide a platform for conducting transparent transactions without needing a third party. Still, after years Bitcoin has become a means of maintaining the value of money. One of the characteristics of Bitcoin is that its number is limited, and no entity can print more Bitcoins. Still, its limited amount can make millions unable to maintain a unit of it.