Abstract

Decentralized exchanges have an essential mission in the DeFi world. These projects have worked very well in the past few years. The general model these platforms use is financing through automated market makers (AMM), but this model could be better than it is now.

Price slippage, sandwich attack, and MEV problem lead to DEX inefficiency in DEXs, which are considerable problems that users and developers are struggling with now. So what is the solution?

Hashflow DEX has been proposed using a different model for market makers to solve this problem. In this article, we will introduce Hashflow services, roadmap, HFT token, advantages and disadvantages, and competitors of Hashflow.

What is Hashflow DEX?

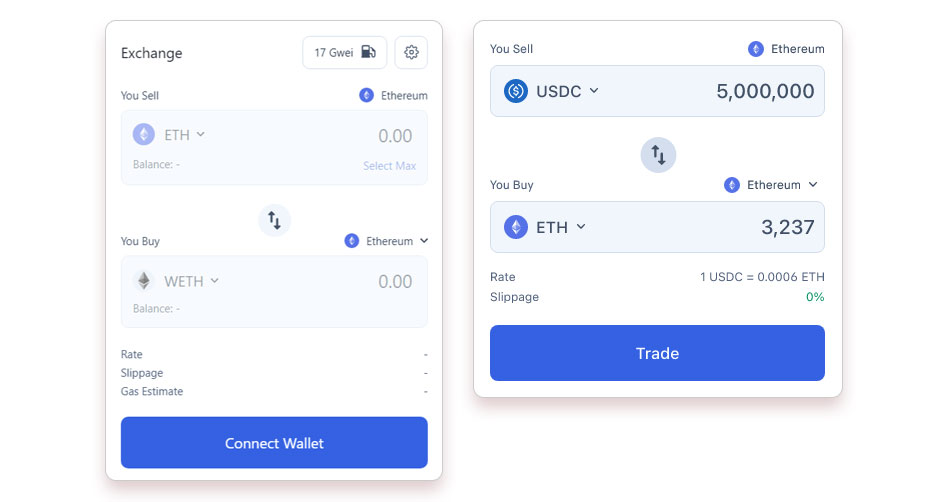

Hashflow is a decentralized exchange or cross-chain DEX based on Ethereum and has a swap service without needing a bridge. Swap without the need for a bridge means the entire swap process among Ethereum, Binance chain, Avalanche, Arbitrum, Optimism, and Polygon networks will work within the program.

This project started working in 2020 and has goals such as the lowest fees among existing DEXs, slippage-free swaps, and secure transactions against MEV. Unlike hashflow platforms that use the AMM system, they will experience slippage when faced with a high volume of transactions.

Request-for-Quote (RFQ)

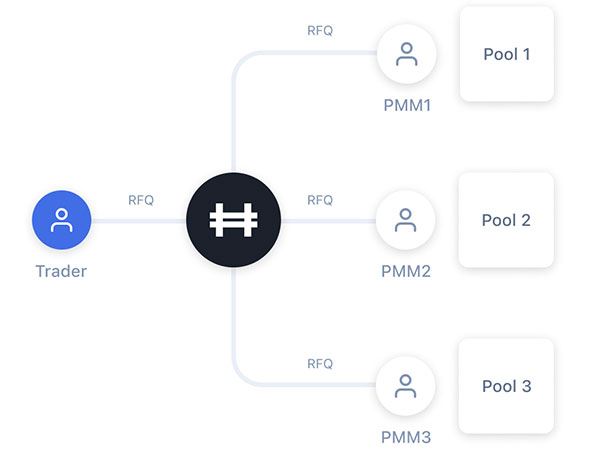

Hashflow Dex uses a professional market maker instead of an automatic market maker mechanism. These types of market makers follow the Request For Quote structure. In this mechanism, once a trader opens a trade position, the system sends a request to the market maker, and the market maker offers the best price.

Instead of using a fixed pricing function that ususally similar systems use in automated market makers, Hashflow uses RFQs to allow professional market makers to raise the required liquidity from any source they can and suggest the best price.

In the RFQ process, the trader does his transaction with a better price. Market makers in the RFQ mechanism guarantee that they will apply the offered price; Therefore, another advantage of this system for traders is not to face price slippage.

The Advantages of Hashflow

The advantage of the Hashflow for liquidity providers:

- Competitive annual profit.

- Single asset liquidity.

The advantage of hashflow for traders:

- More reasonable price.

- Zero slippage.

- Not facing sandwich attack and front running.

- Competitive fee compared to some DEX.

Disadvantages

- Limited token support for swaps.

- It takes time to complete the transaction in some cases.

- The cost of some transactions that use the bridge.

Investors

Famous and reliable names have invested in the Hashflow project. Kraken and Coinbase are two exchanges that have already invested in Hashflow. Other institutions and companies that invested in Hashflow are:

- Galaxy Digital

- GSR

- Wintermute

- Altonomy

- Ledger Prime

HFT Token

The total supply of ERC-20 HFT tokens is 1,000,000,000, and the circulating supply upon listing will be 175,229,156 (~17.52% of the total token supply) and launched on October 31st, 2022.

Token Distribution

| Binance Launchpool | 1.50% |

| Investors | 25.00% |

| Community Treasury | 1.00% |

| Community Rewards | 11.58% |

| Ecosystem Development | 37.61% |

| Future Hires | 2.50% |

| Advisor | 1.50% |

| Team | 19.32% |

* Percentage of the total token supply.

Conclusion

Hashflow DEX operates on the Ethereum network. This decentralized exchange has provided a platform for traders to swap their assets without slippage by using the professional market maker model of the RFQ mechanism. Hashflow governance Token is HFT and launched on October 31st, 2022.