On-Chain Data

“On-Chain Data” is information gathered from the whole written data on the blocks of a specific blockchain. “On-Chain Data helps traders to make accurate decisions. However, we should remember that the crypto market is a new market with less than a couple of decades of history. We must wait for challenging changes that cause demolitions of older achievements and cause the rise of new indexes.

On-Chain Analysis

In Cryptocurrency Market, “On-chain analysis” (so-called blockchain analysis) is a field that helps investors examine cryptocurrencies’ by getting help from fundamental factors to enhance investment and trading determinations.

And also, “On-chain data” includes the information of all transactions on a specific Blockchain network or maybe put all the written information on the blocks of a Blockchain differently. In the case of a public Blockchain, this information is available for everyone to see.

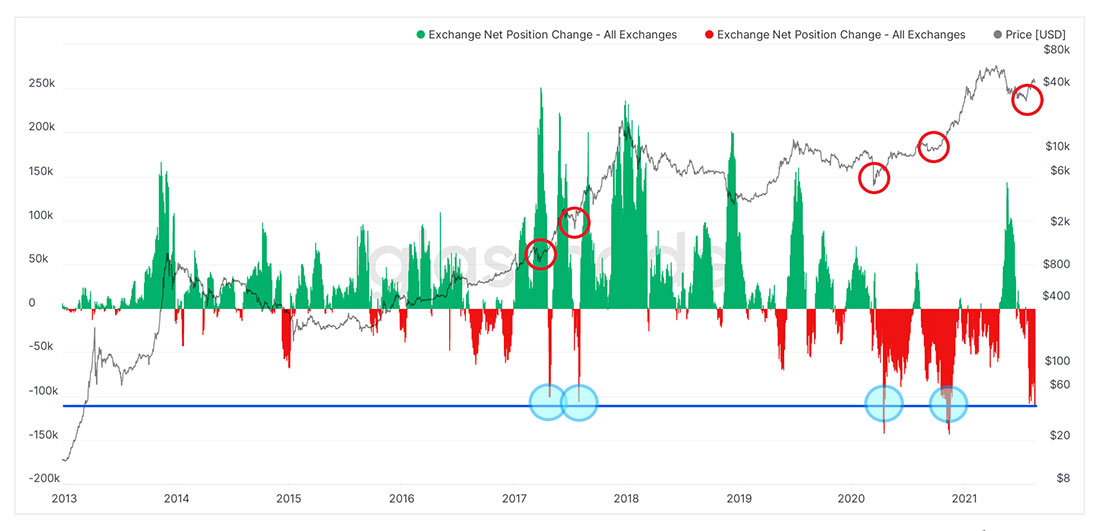

The on-chain analysis is a new field that helps us check fundamental factors, utilities, and transactions of a cryptocurrency and the relevant blockchain network. Cryptocurrency analysts get help from “on-chain” data to better understand the market movements in the future by improving their knowledge by investigating influential aspects. Usually, items like transactions volume, details about the extraction such as block rewards, price dependencies, capital inflows and outflows from exchanges, and such things, are critical points for Market analysts.

The on-chain analysis is similar to fundamental analysis, except the “on-chain” assessments, which use data and information in the blockchain to determine the value of a network. In contrast, fundamental analysis determines the actual value of a project or company. By combining technical analysis and “on-chain” analysis, analysts in this field obtain short-term entry and exit points for cryptocurrencies.

In a few words, one of the most important usages of the on-chain data is using the data from transactions and wallets to determine the total value of a network.

How to get on-chain data?

Imagine the situation where a third-party non-dependently wants to set up a node on a network that another user wishes to receive information from the same network!

In this method, because all nodes keep a copy of the ledger to get On-Chain data requirements are technical information, sufficient hardware power, and Internet connection, the prerequisites for this work vary according to the specifications of each network.

Although there is another alternative to using data provided by data provider sites, it is necessary to know that users usually must pay a subscription fee to access the full range of provided data in these types of provider websites. Still, most sites also offer free plans. Some helpful sites are;

- Glassnode – https://glassnode.com/

- Santiment – https://santiment.net/

- Look into Bitcoin – https://www.lookintobitcoin.com/

- Into the Block – https://www.intotheblock.com/

- Crypto Quant – https://cryptoquant.com/

Limitations in on-chain analysis?

Regardless of promises to resolve problems and occur improvements; still, there are some limitations in On-Chain Data, which recount below:

- It has been less than a couple of decades, cryptocurrencies have unveiled the way we know them today. There might be influential factors, indicators, and indexes in the future, or even some of the essential elements we know today will be unimportant in the next few years. It will change over time, like what we have witnessed in history happened for other markets, such as the same issues in traditional markets like monetary markets, energy, and other specialized markets.

- Scalability solutions such as Lightning Network for Bitcoin and optimistic solutions (Optimism and Arbitrum) for Atrium (Ethereum) are less transparent and affect the volume of transactions in the Layer 1 network. With the increasing use of these solutions, one must either wait for the data to evolve or consider their effect on the Layer 1 network.

- For traders who are active in concise terms, this data may not be of much value because their time horizon is usually longer. This group of traders can use on-chain analysis to complete their first way of analysis.

In this article, we together learned what exactly is on-chain analysis. As mentioned in the prior, “on-chain analysis” is something like fundamental analysis, except that fundamental analysis examines the value of a company or project. In contrast, in “on-chain analysis,” the method only looks at the value of a network using its blockchain data.

Conclusion

The on-chain analysis is a type of analysis that focuses exclusively on one crypto-asset by looking at historical trends and the actual value of that particular cryptocurrency. Concerning the short history of digital currencies, even the King of coins, known as bitcoin (about a decade), the gathered information and data during these years can’t be undoubtedly accurate data.

It is most likely they change over time, even tomorrow or within the next crisis like another pandemic, war, or financial issues that might get involved in the whole or part of the world. Hence, we recommend traders be sure to experiment with these methods before deciding how to use this information.