Abstract: Solana’s new blockchain technology has attracted substantial developer communities built on its decentralized crypto apps (So-called DApp) and marketplaces. Solana has a highly functional open-source capacity for projects that are more powerful and scalability to support the vision of a decentralized world. For this reason, Solana is a severe competitor to Ethereum. This article will discuss the Solana network, explain its mechanisms, and talk about SOL, the native cryptocurrency of the blockchain network of the Solana.

Introduction

With a prosperous and unprecedented ovation of blockchain by entities and individuals, Anatoly Yakovenko, the former executive of Qualcomm company, established Solana in 2017 and officially launched it in 2020. Solana has a highly functional open-source capacity for more powerful projects and scalability to support the vision of a decentralized sphere.

This blockchain network is a public blockchain developed and designed to facilitate the creation of smart contracts and decentralized applications (DApp) and provide open infrastructure and decentralized finance (DeFi) solutions. Solana is a blockchain network that supports many decentralized applications and has its native token known as SOL, and the society of Solana members uses the coin for staking.

What is Solana?

Anatoly Yakovenko, a former executive at Qualcomm company, founded Solana in 2017 by Anatoly Yakovenko, a former executive at Qualcomm company. However, the project was officially launched in 2020 by the Solana Foundation. Like other third-generation blockchain platforms, Solana’s mission is to provide an ecosystem for creating DApps that are scalable and efficient.

Solana is a public blockchain developed and designed to facilitate the creation of smart contracts and decentralized applications (DApp) and provide open infrastructure and decentralized finance (DeFi) solutions. Solana is a blockchain network that supports a large number of decentralized applications. There are currently more than 400 projects on the network, including lending and trading platforms, decentralized Internet or Web3 applications, NFT markets, and blockchain games.

$SOL cryptocurrency is the native financial instrument of the Solana network, which users can use the token for staking. Solana Blockchain uses staking to secure its network. This network has a token writing standard called SPL, which stands for Solana Program Library, a structure for making and producing tokens on the Solana network platform.

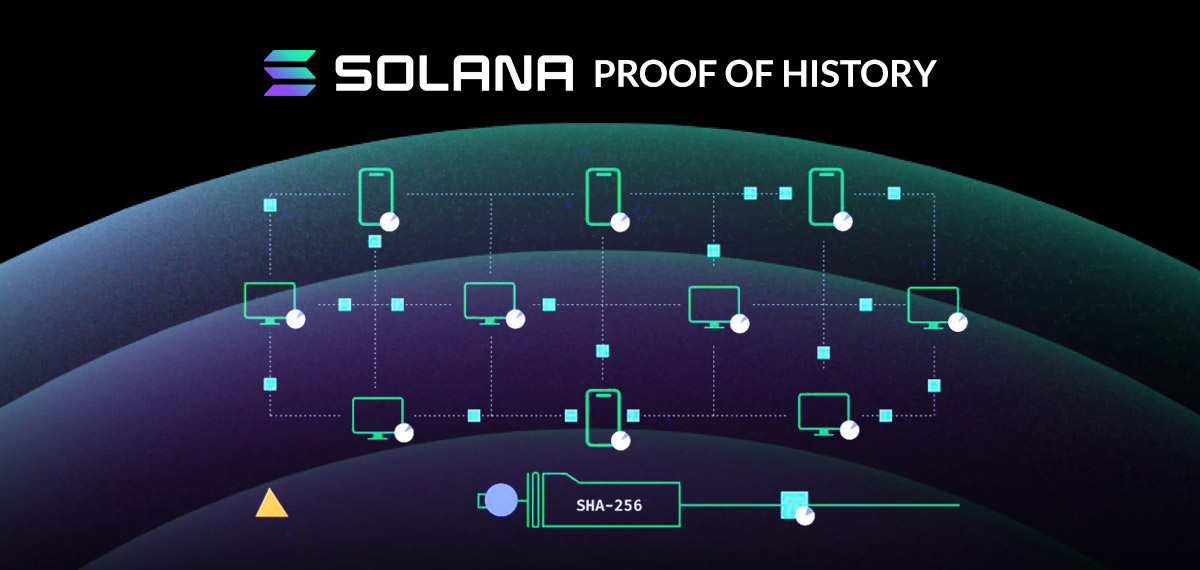

Schematic of the Proof of History (PoH) Consensus Mechanism to understand better how nodes the Solana Blockchain arrays validator nodes.

How Does Solana Work?

Solana’s robustness of speed and high scalability characteristic is the adopted consensus mechanism using this combination of Proof of Stake (so-called Proof of history). As a result, they can support 50,000 TPS (transactions per second) without sacrificing decentralization. The system produces new blocks every 400 milliseconds (at the moment) with the help of 200 validating nodes, all while maintaining close to zero network fees.

The Solana network uses the Proof of History protocol (PoH). Proof of History protocol is not a consensus mechanism. It is part of Solana’s consensus mechanism, the Proof of stake (PoS). PoH is the timestamp of transactions added to the Solana blockchain, besides Decentralized Clock is an added feature to improve the functionality of this Blockchain ecosystem. To better understand how fast validating a block in each 400 is better to know that the sever competitor of the Solana blockchain, Ethereum, only validates a block in 15 seconds (APX 37 times faster than Ethereum), and in the Bitcoin blockchain, this rate was every 10 minutes in the beginning.

Many networks, such as Bitcoin and Ethereum, process higher-reward transactions faster. This fastness is due to the Proof of Work (PoW) algorithm, allowing miners to choose the most profitable transactions to verify and validate. In contrast, PoH has the same function as a stopwatch. Because nodes can trust this decentralized Clock and order incoming messages, they create the following blocks without coordinating with the other validators and the entire network.

SOL Token & Its Tokenomics

Solana’s native coin is $SOL. One of the applications of Solana cryptocurrencies is for staking, which provides security and powers the network through a PoS mechanism. Users can pay transaction fees on the network and smart contracts with the $SOL.

Solana Tokenomics

The Solana total circulation supply will be 489 million $SOL tokens. Almost 340 million of these have already entered the market.

SOL Token Distribution

- Seed Sale tokens comprise: 16.23%

- Founding Sale tokens comprise: 12.92%

- Validator Sale tokens comprise: 5.18%

- Strategic Sale tokens comprise: 1.88%

- Coin List Auction Sale tokens comprise: 1.64%

- Team tokens comprise: 12.79%

- Foundation tokens comprise: 10.46%

- Community tokens comprise: 38.89%

Disclaimer

Please note that the opinions expressed herein in this article are not investment advice and are only for educational purposes. The Minerium team will not take responsibility if any of the audiences of this article invest in mentioned options.

Conclusion

Primary blockchains had some problems, such as low transaction processing speed or low bandwidth. The third generation of blockchains, such as the Solana network, has solved many of these problems through innovations, making this Blockchain an adamant competitor to older blockchains such as Bitcoin and Ethereum. Of course, do not forget that the blockchain space is overgrowing, and new projects are constantly appearing in the blockchain industry.